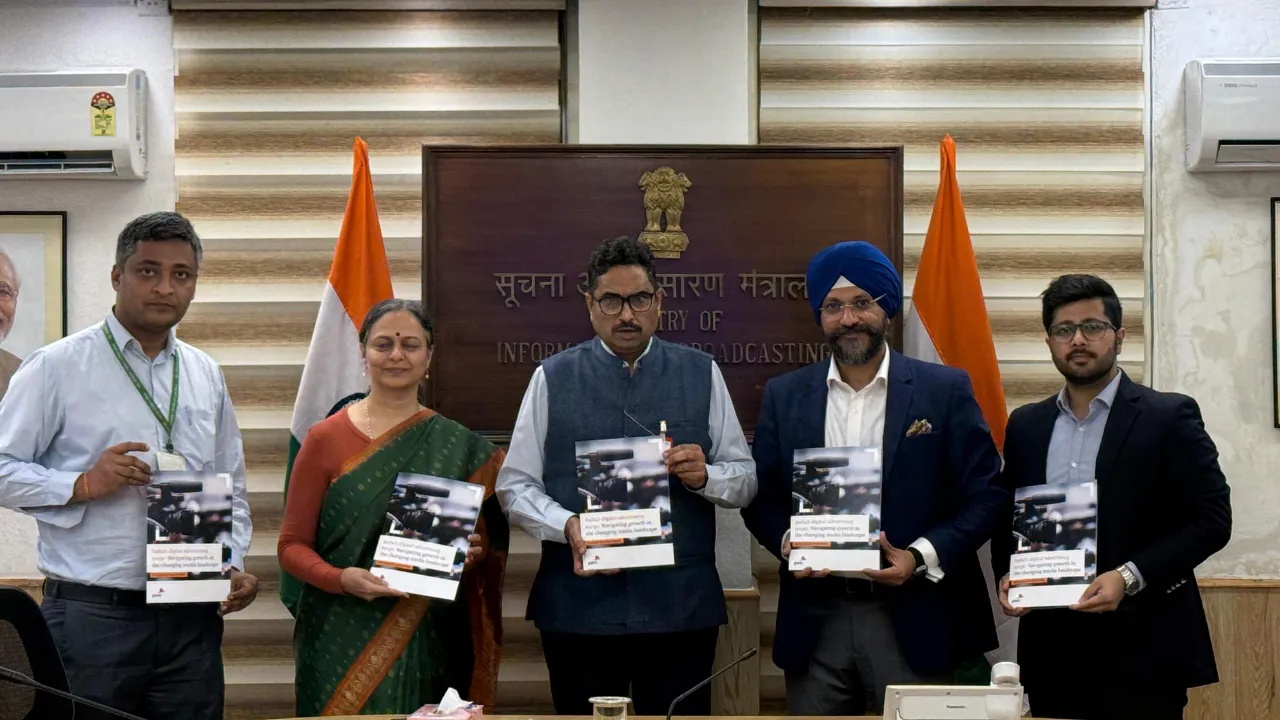

PwC India has launched the Entertainment and Media Outlook – India Report, a study detailing the vast potential and opportunities of India’s entertainment and media (E&M) sector. According to PwC India’s report “Global Entertainment & Media Outlook 2024–28: India perspective,” the Indian E&M industry is projected to grow at a CAGR of 8.3% to hit Rs 3,65,000 crore (19.2 Bn USD) outpacing the global rate of 4.6%.

Despite economic challenges and geopolitical tensions, global E&M revenues grew 5.5% year-on-year, from Rs 1,38,91,000 crore in 2022 to Rs 1,73,59,000 crore in 2023. Currently, the US leads the global E&M market by revenue, with China in the 2nd place and India at the 9th.

Manpreet Singh Ahuja, chief digital officer and TMT leader at PwC India commented, “India’s Entertainment & Media sector is on the cusp of a major transformation. According to our Global Entertainment & Media Outlook 2024-2028, key growth drivers such as digital advertising, OTT platforms, online gaming, and Generative AI are shaping the future of the industry. These rapidly expanding segments are positioning India as a global leader in innovation and growth. Businesses that adapt and innovate in these areas are poised to seize unparalleled opportunities in this dynamic landscape.”

The report states that with better connectivity, increased advertising revenues, and favorable FDI policies, India is expected to see high growth in the next five years. The country’s millennial and Gen-Z population, over 91 crore, has access to low-cost data. India has 80 crore broadband subscriptions, 55 crore smartphone users, and 78 crore internet users. Indians are spending 78% of their time on mobile apps related to entertainment and media (E&M). To support this growth, the Government of India will host the inaugural WAVES summit to boost the E&M sector globally through collaboration and innovation.

With growing consumption and gross domestic product (GDP) growth in India, the advertising market is projected to grow at a 9.4% CAGR from Rs 1,01,000 crore in 2023 to Rs 1,58,000 crore in 2028, which is 1.4x the global average. Most of this growth will come from digital front (internet advertising), which is expected to grow at a 15.6% CAGR, rising from Rs. 41,000 crore in 2023 to Rs. 85,000 crore in 2028. Internet advertising’s year-on-year growth, which was 26.0% in 2023, will remain in double digits throughout the forecast period (2024–28), and is expected to be 12.2% in 2028.

This shift towards cord-cutting is expected to accelerate. Traditional TV advertising will grow at a 4.2% CAGR between 2023 to 2028, while global revenues are set to drop by -1.6%. India is poised to become the fourth-largest TV advertising market by 2026.

As per the 2024 outlook, other subsectors will also witness growth that surpasses global averages:

The total online gaming and esports revenue in India stood at Rs 16,480 crore in 2023 and is expected to reach Rs 39,583 crore by 2028, growing at a CAGR of 19.2%. With the inclusion of real money gaming (as per PwC’s India Gaming Report ‘24) the total gaming and esports revenue would amount to Rs 33,000 crore (4BnUSD) in 2023 and is expected to reach Rs 66,000 crore (8BnUSD) by 2028 at a CAGR of 14.5%. Globally, video games and esports revenue will increase at a CAGR of 8.0%

Over-the-top (OTT) will be the third-fastest growing segment with a CAGR of 14.9%, putting the country in lead by 2028

Infrastructure enhancements have supported massive growth in India’s out-of-home (OOH) advertising market which grew by 12.9% in 2023. It is expected to continue to grow at a 7.6% CAGR

When it comes to print advertising revenues, despite a global decline at a CAGR of -2.6%, India’s market is expected to grow at a rate of 3%, making it the 3rd largest Print market in the world by 2028

India’s cinema market continues to expand, growing at a 14.1% CAGR

The total music (live, recorded and digital) revenue grew from Rs 2,416 crore (293 Mn USD) in 2019 to Rs 6,686 crore (811 Mn USD) in 2023. It is expected to cross INR 10,899 crore (1.3 Bn USD) by 2028, growing at a CAGR of 10.3%

At a 5.6% CAGR, India will stand out as having the highest B2B revenue growth rate in the world over the next five years. In contrast, global B2B revenue growth is forecasted at a 1.9% CAGR

The report highlights four key opportunities in the E&M sector. Internet advertising emerges as the fastest-growing market in Asia-Pacific and the second globally, with a projected 15.6% CAGR (2023–2028). Companies can prioritise regulatory compliance and leverage data analytics to enhance trust and implement targeted advertising strategies.

OTT platforms in India, the world’s fastest-growing, saw a 20.9% rise in 2023, reaching Rs 17,496 crore (2.1 Bn USD), and are projected to double by 2028 (14.9% CAGR). Focusing on advertising-supported tiers, market consolidation and regional narratives can boost engagement.

Online gaming and esports are rapidly expanding, projected to represent 9% of the E&M sector by 2028. Promoting responsible gaming and investing in high-quality AAA games will position Indian studios on the global stage. Lastly, generative AI (GenAI) is set to transform content creation, personalisation and monetisation, with over 70% of global companies expected to adopt it by 2025. Early adoption of GenAI in India can drive hyper-personalised content and dynamic advertising campaigns.

Video:

Author: Sania Khan